The government has been trying to implement GST since 2011 but the proposed plan was greeted by plenty of backlash by the public. 603-7785 2624 603-7785 2625.

Malaysia Sst Sales And Service Tax A Complete Guide

Countries Implementing GST or VAT.

. GST is imposed on goods and services at every production and distribution stage in the supply chain including importation of goods and services. Implementing a goods and services tax GST regime can be a lengthy and turbulent process. However the scope and complexity of GST requirements often makes it difficult for companies to.

Number of country based on region are as follows-. When did GST end in Malaysia. Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel.

Malaysia announced the abolishment of its Goods and Services Tax GST. Currently there are 160 countries in the world that have implement VATGST. There were many responses when the Malaysian government first announced the Financial Budget for Malaysia year 2010 both good and bad.

Furthermore this might involve lowering the revenue rate or keeping it in a position where it is acceptable. In Malaysia our tax system involves several different indirect taxes. The GST rate in Malaysia is nearly 4 percent while the registration threshold is 500000 MYR per year.

GST Implementation in Malaysia The Argument. Malaysias recent addition of a Goods and Service Tax GST which was passed by the government during the third quarter of 2011 but delayed until April 2016 has been the cause of much confusion within ASEANs second most developed economy. A goods and services tax GST is a tax on consumption or in other words spending.

GST rates are promised at 4 out of the normal 10 or 5 charged in restaurants. GST will not be imposed on piped water and first 200 units of electricity per month for domestic. But when they have been undecided about GST it sparked extra discussion on no matter whether its going to reward the Rakyat.

Certain essential goods will be exempted from GST. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent. But when they were undecided about GST it sparked more conversation on whether itll benefit the Rakyat or further threaten.

The hope and purpose of GST is to replace the sales and service tax which has been used in the. The Vibes file pic October 28 2021. With Malaysia looking to establish its own regime Lachlan Wolfers Asia-Pacific regional leader for indirect taxes at KPMG explores the common pitfalls and looks at the lessons.

Roughly 90 percent of the worlds population live in countries with VAT or GST. For Budget 2022 the government is expected to allocate a total sum of RM3483 billion which is 106 higher than the revised RM3148 billion in 2021. The GST has long been a source of political debate in Malaysia.

There are currently 160 countries in the world that use GST as a form of tax collection. Hence it is anticipated that the government isnt looking for an immediate change. Here are some of the tax rates of countries around the world who have implemented GST or VAT.

Standard-rated supplies are goods and services that are charged GST with a standard rate. The road to GST implementation. The government had implemented Goods and Services Tax GST starting from 1st April 2015 with 80 to 90 compliance from a taxable person on the first day of its execution with little commotion from end customers.

Deloitte Malaysia experts propose tax shelters incentives to get Malaysians back on their feet. But here it comes now. GST is collected by the businesses.

Malaysian Goods and Services Tax Act 2014 has been gazetted on 19 June 2014. As announced by the Prime Minister during the annual budget 2014 presentation GST will be implemented. Out of 160 countries eight countries are not United Nation UN Member States-.

Goods Services Tax GST is now Law in Malaysia and to be formally known as Goods And Services Tax Act 2014. At this point in time the rate may be slightly higher. This means taxes are lower now Consumers need not pay more for one area but its divided into many other source of tax payments.

After spending a number of years studying Goods and Services Tax GST Malaysia was the last country in the Association of Southeast Asian Nations ASEAN excluding Brunei to implement GST in 2015. There were being quite a few responses when the Malaysian government to start with declared the Financial Funds for Malaysia yr 2010 both equally fantastic and bad. It is important for businesses both local and foreign that have taxable supplies of more than 500000 MYR to register with and implement GST.

On goods brought into the country. Malaysia may look at a possible implementation of the Goods and Services Tax GST in the medium term likely by 2022 or 2023 to help correct the governments fiscal position and. The Malaysian government is planning to re-implement goods and services tax GST.

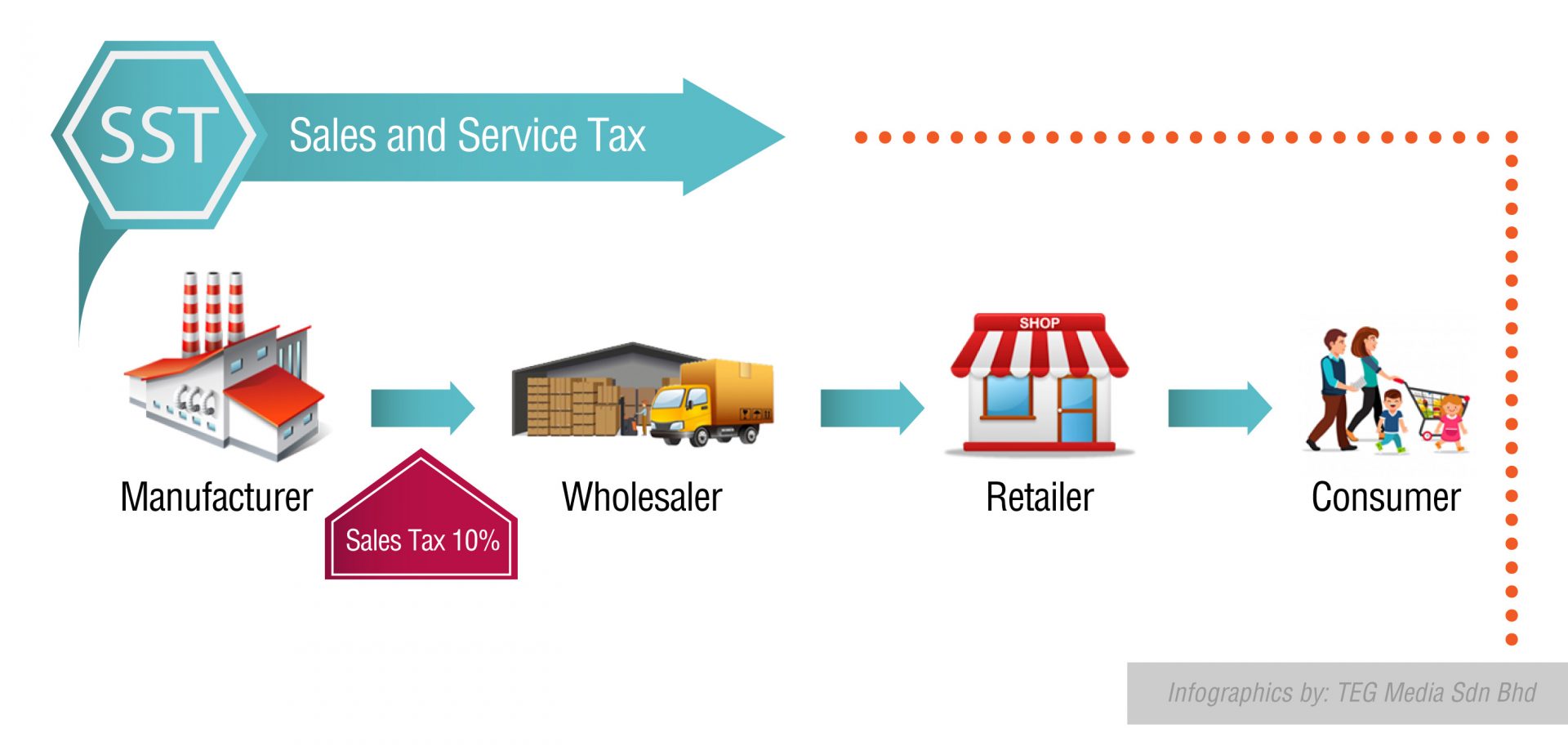

Currently Sales tax and service tax rates are 10 and 6 respectively. In 2005 then-Prime Minister Abdullah Ahmad Badawi announced that his administration planned to implement the GST by 2007. In Malaysia the GST has a broad base and is imposed on about 40000 goods and services.

Implementation will not occur until middle to late 2011 or 2012. GST Implementation in Malaysia The Argument. List of Countries Implementing VATGST.

The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6. GST is a consumption tax based on the value-added concept. However Malaysia became the first to abolish GST in 2018 after the fall of the Barisan Nasional government in the Malaysian 14th General Election.

For GST Malaysia there are 3 types of supply. Sales tax and service tax will be abolished. Lessons from Australias GST Implementation for Considering the US.

GST will be implemented on 1 April 2015 and the standard rate of GST is fixed at 6. It will replace the 105 services and goods tax. However the SST has a narrow base and only captures about 40 of the locally manufactured and imported goods.

However this decision is likely to be implemented in 2022 or 2023.

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Gst And How It Affects The Luxury Goods Industry In Malaysia Bagaddicts Anonymous

A Guide To Gst In Malaysia How Does It Affect Me

1 Gst Charge At Each Level Of Supply Chain Source Royal Malaysian Download Scientific Diagram

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

A Guide To Gst In Malaysia How Does It Affect Me

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Goods And Services Tax Malaysia Gst Ts Dr Mohd Nur Asmawisham Bin Alel

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

Cover Story Why Is There Gst When Oil Prices Are Up Again The Edge Markets

Malaysia Launches Consumption Tax Despite Public Unease

An Introduction To Malaysian Gst Asean Business News

Sst Vs Gst How Do They Work Expatgo

Revenue Change Due To Transition From Gst To Sst Download Scientific Diagram

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Doc Article 2 An Overview Of Gst Malaysia Brief History Of Goods Services Tax Gst Malaysia Yeehui Hayley Academia Edu